Property and casualty insurance carriers often struggle with fragmented data systems, where information is scattered across separate policy, billing, and claims platforms. This fragmentation hinders a unified understanding of business operations, making it difficult to visualize business metrics cohesively. Limited access to flexible and cost-effective analytics tools further exacerbates this issue. Traditional analytics platforms are often inflexible and come with high costs—mainstream tools like Power BI may not cater specifically to the insurance industry's unique needs.

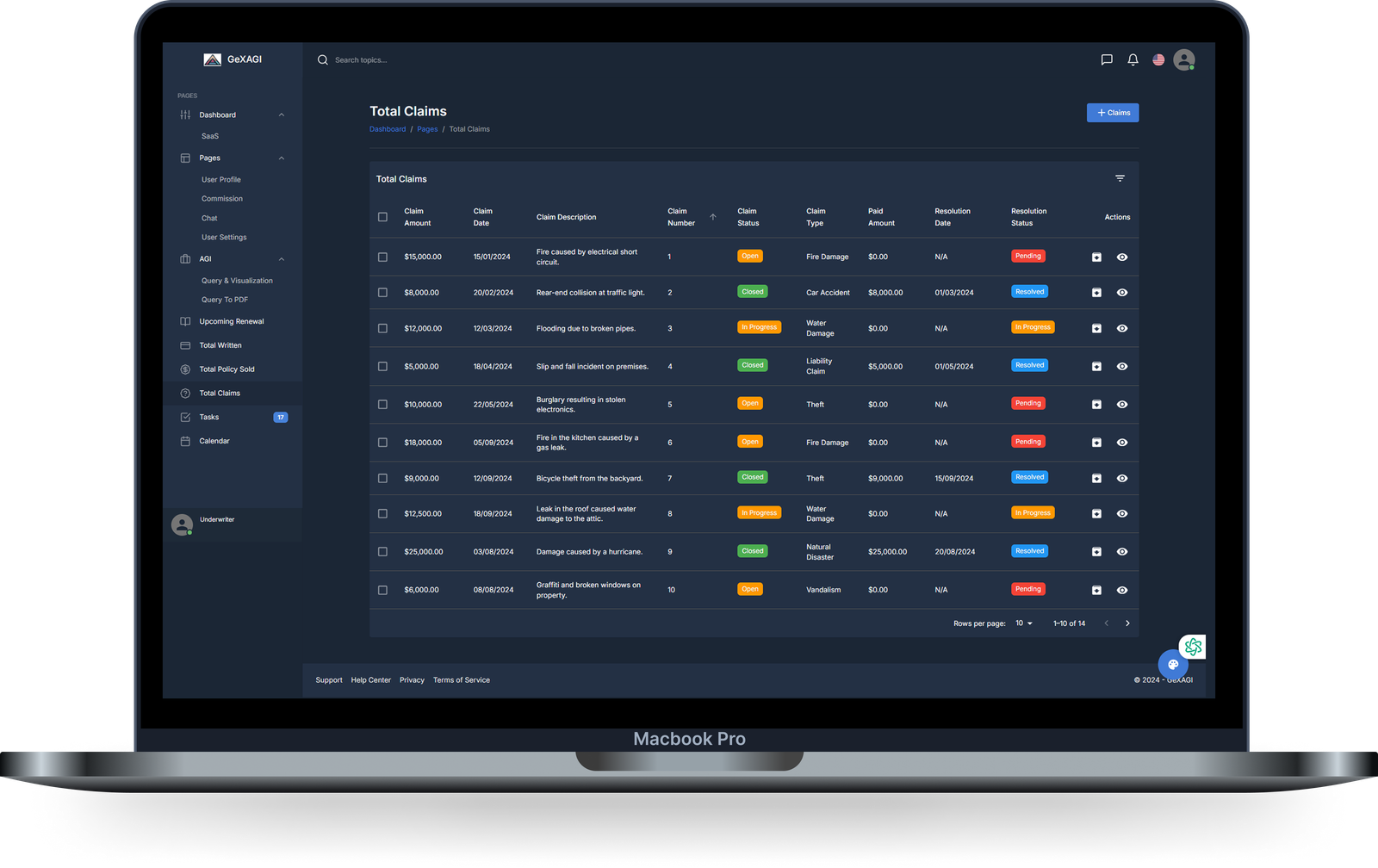

The challenges intensify when companies acquire others that come with multiple legacy systems. Integrating these disparate systems introduces complexities and data inconsistencies, leading to inefficient decision-making and missed growth opportunities. Tracking individual policies becomes a daunting task, impacting customer satisfaction and regulatory compliance.

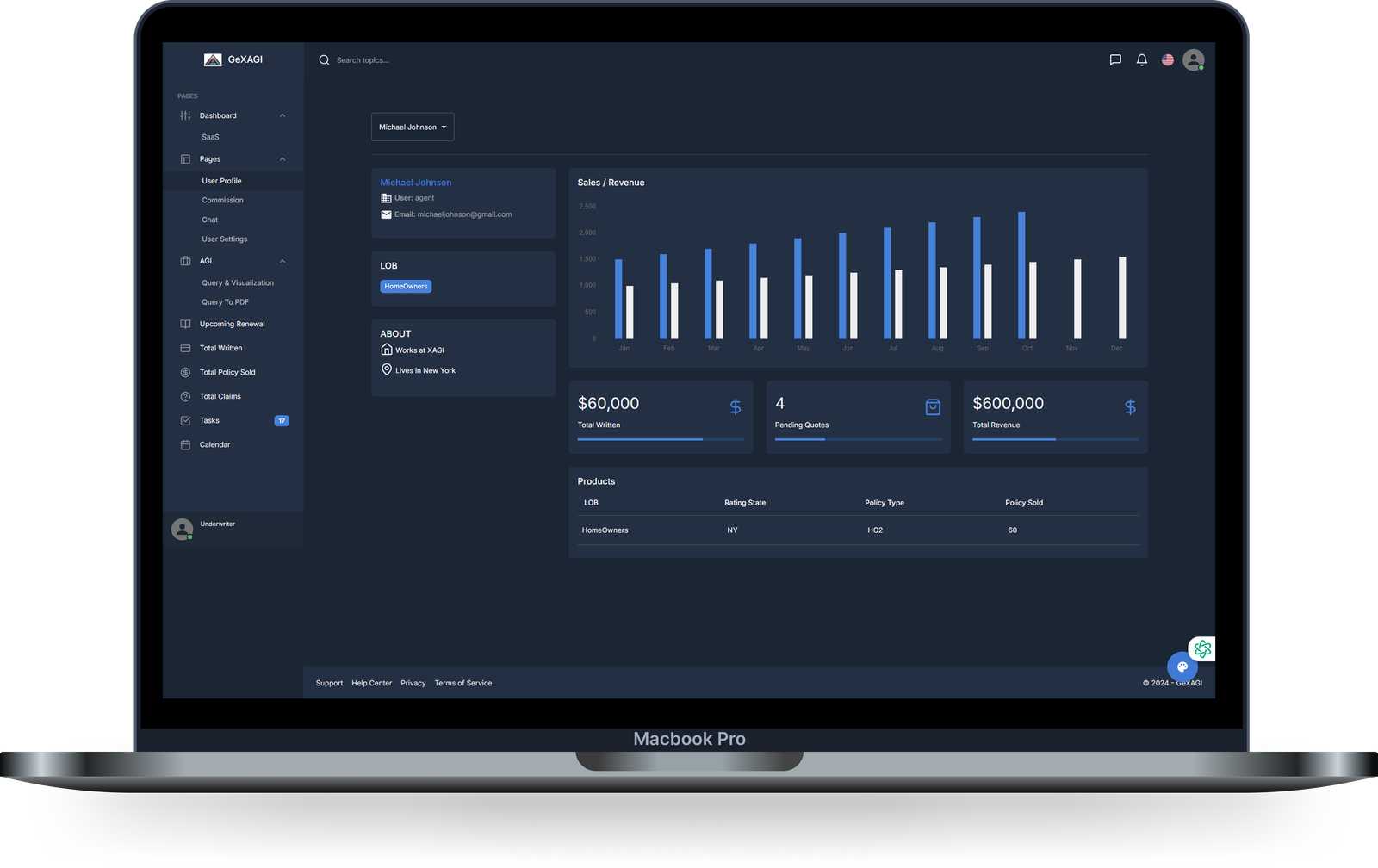

Underwriters and agents face their own set of challenges. They often struggle to access complete data, making it hard to assess risks accurately and respond swiftly to customer needs. The inability to visualize data cohesively hampers their effectiveness and slows down operational efficiency.

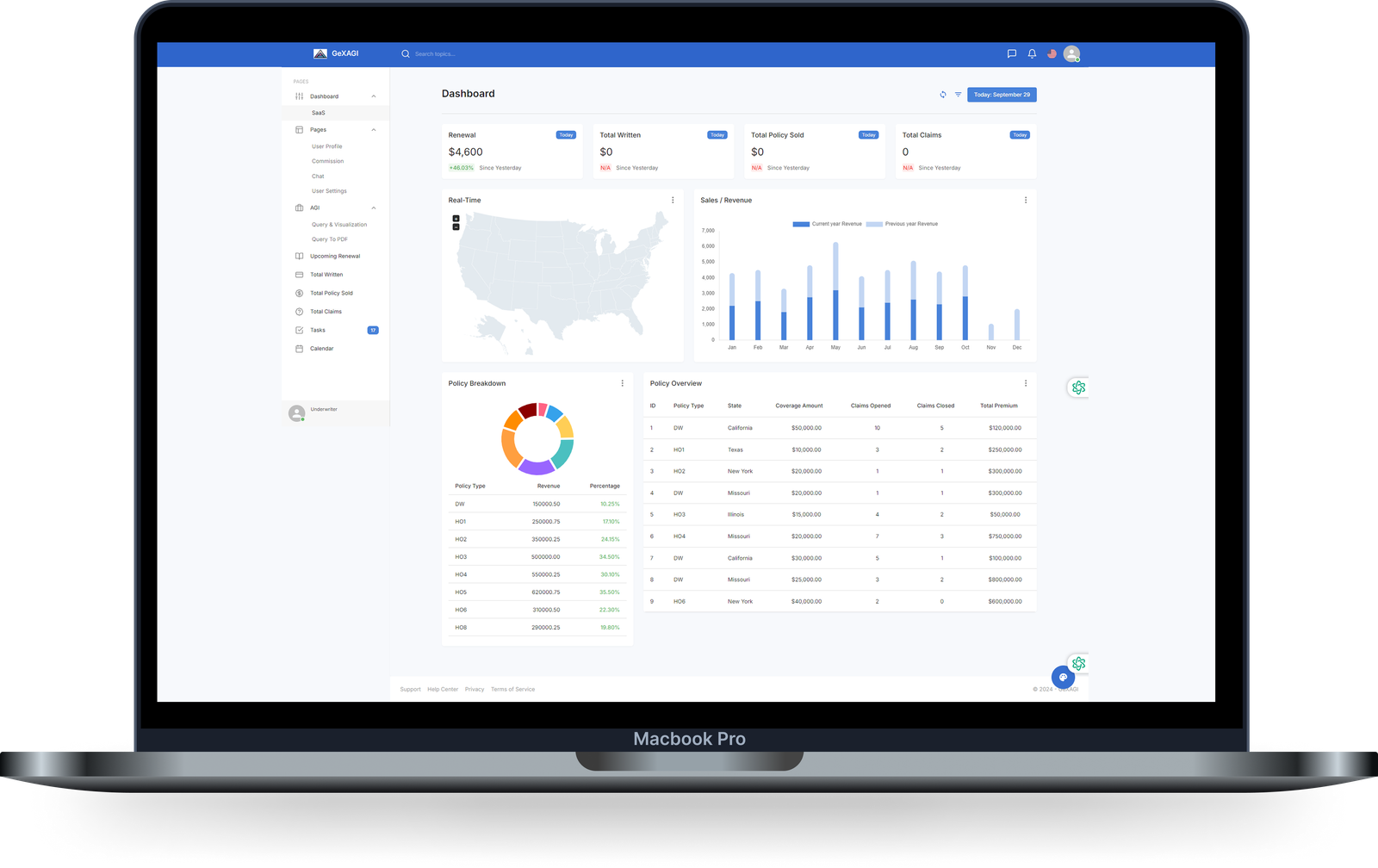

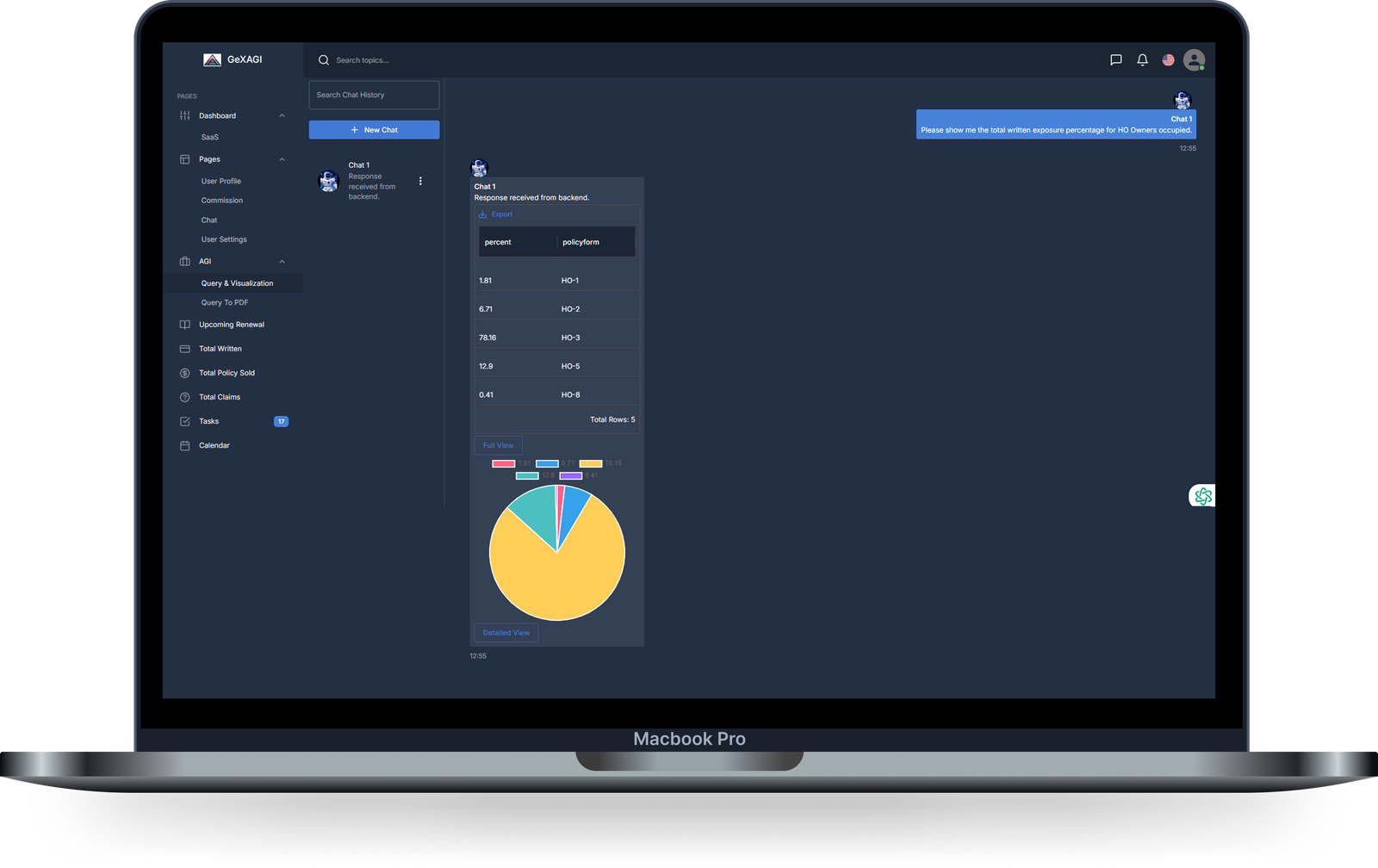

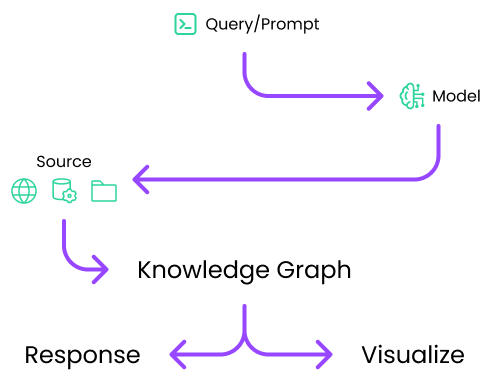

At GeXAGI, we leverage advanced AI and machine learning technologies to unify your data, providing a holistic view of your business. Our innovative solutions simplify data management by integrating seamlessly with your existing systems, eliminating the need for costly overhauls. We offer flexible, cost-effective analytics tools tailored to your specific needs, empowering your team with real-time insights for proactive strategy and operations management.

Why Choose GeXAGI?

We bring industry expertise with specialized solutions designed specifically for the insurance sector. By utilizing the latest advancements in AI and ML, we ensure you stay ahead of the curve in a rapidly evolving market. Our scalable solutions are adaptable to businesses of all sizes, promoting growth and efficiency at every stage. With GeXAGI, you can overcome the challenges of fragmented data systems and propel your business toward exponential growth.